corporate tax increase effects

Scrapping the 45p top rate of income tax was hugely divisive because it handed benefits worth tens of thousands of pounds to the highest earners in the country but its cost. When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise.

A Cut In The Corporate Tax Rate Would Provide A Significant Boost To The Economy Tax Foundation

As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th and.

. Under this the 21 corporate tax rate will increase to 28. PWBM analyzed an increase in the corporate income tax rate to 28 percent from its current level of 21 percent as part of the Biden presidential campaign platformHere. In this paper we review literatures linking the tax changes to capital formation and to economic growth.

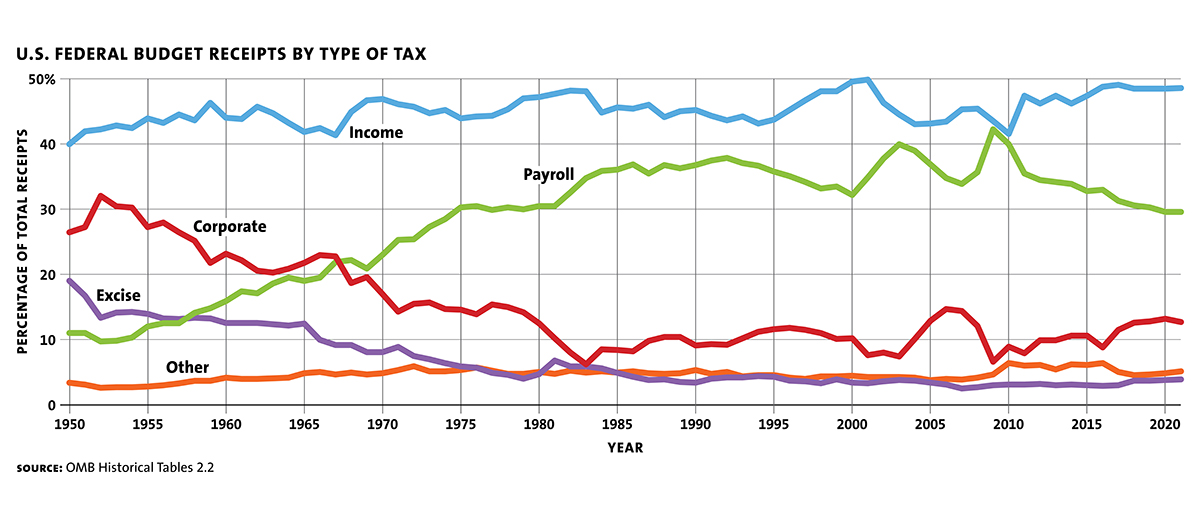

Effects on the Budget. Social Security payroll tax to earnings over 400000. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are.

A 15 minimum tax will also be imposed to ensure big companies are paying their taxes properly regardless of the. The corporation tax will increase to 25 from 1 April 2023 affecting companies with profits of 250000 and over. According to the Tax Foundation raising the corporate rate will have an negative effect on GDP.

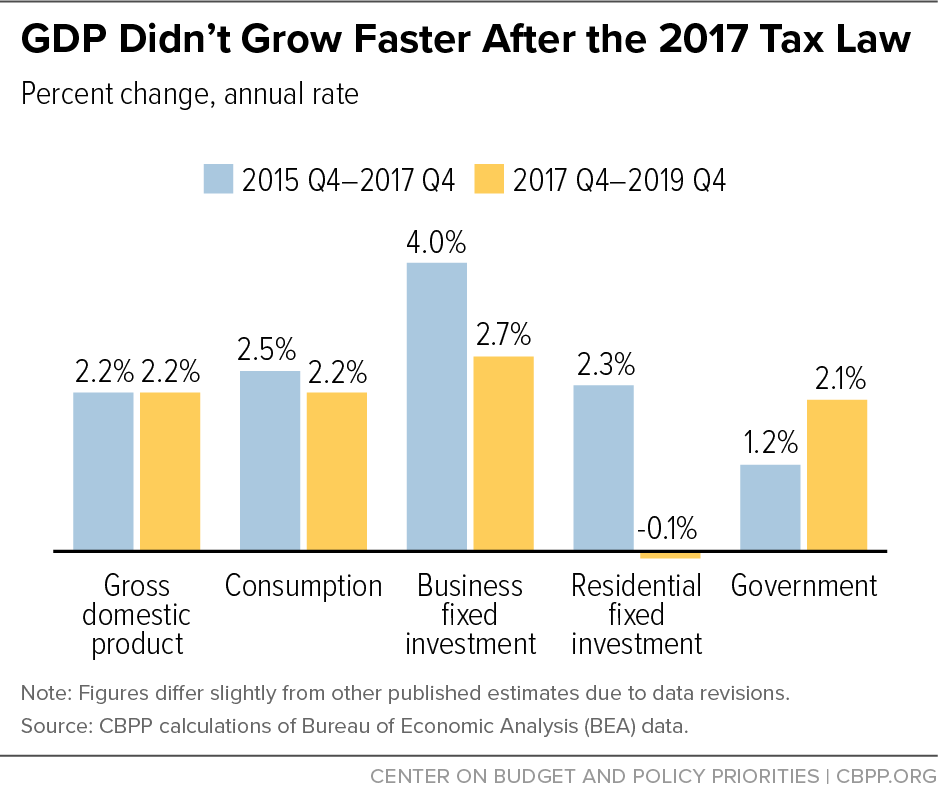

The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35 percent to 25 percent would raise GDP by 22 percent increase the private-business capital stock by 62 percent boost wages and hours of work by 19 percent and 03. The legislation that provided for this increase also sets out. In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens.

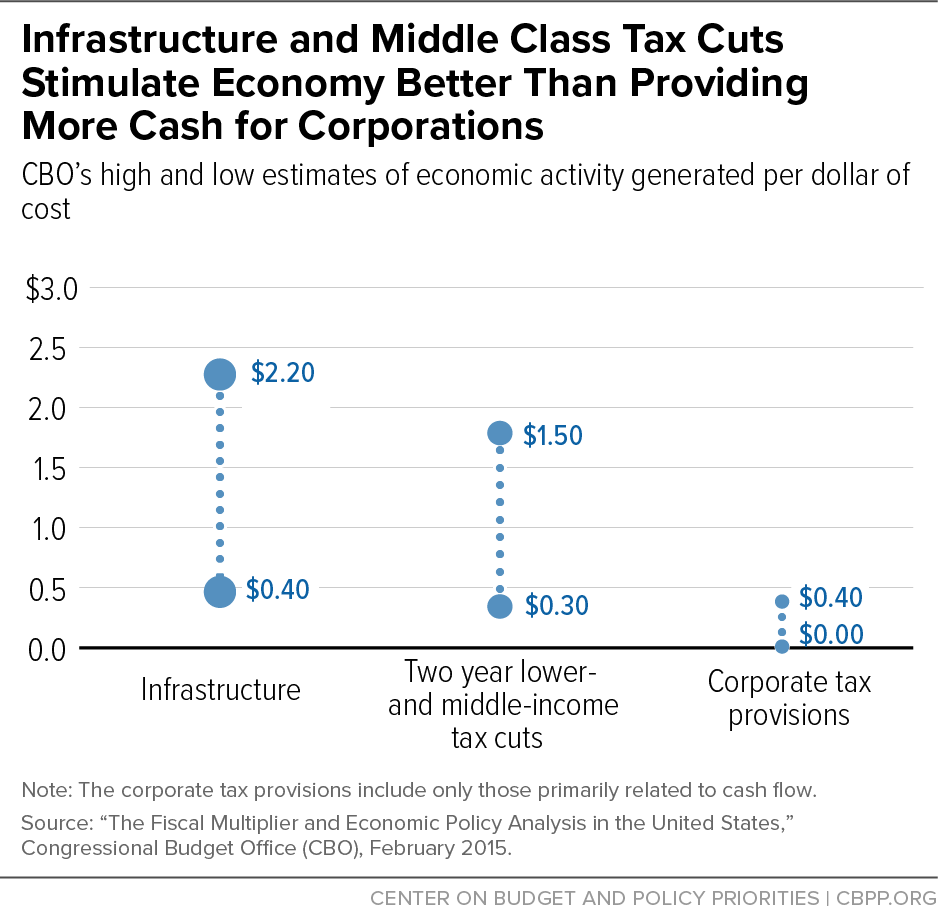

Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. Congress is considering these tax increases and new mandates that will impact small businesses. While a full estimate of the growth impact of the Unified Framework must.

Bidens budget assumes the BBBA increases take effect and would pile on another 25 trillion of tax increases 16 trillion from corporate and international tax changes 780. Limiting the Small Business Deduction IRS Section 199A Raising the corporate. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating certain.

Their model indicates raising the corporate rate to 28 could have a -08. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. Corporate Income Taxes and Corporate Hiring Decisions.

Using 1970-2007 data from the United States a Tax Foundation study. But Republicans are already. The option would increase revenues by 96 billion from.

This option would increase the corporate income tax rate by 1 percentage point to 22 percent.

How The Tcja Tax Law Affects Your Personal Finances

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

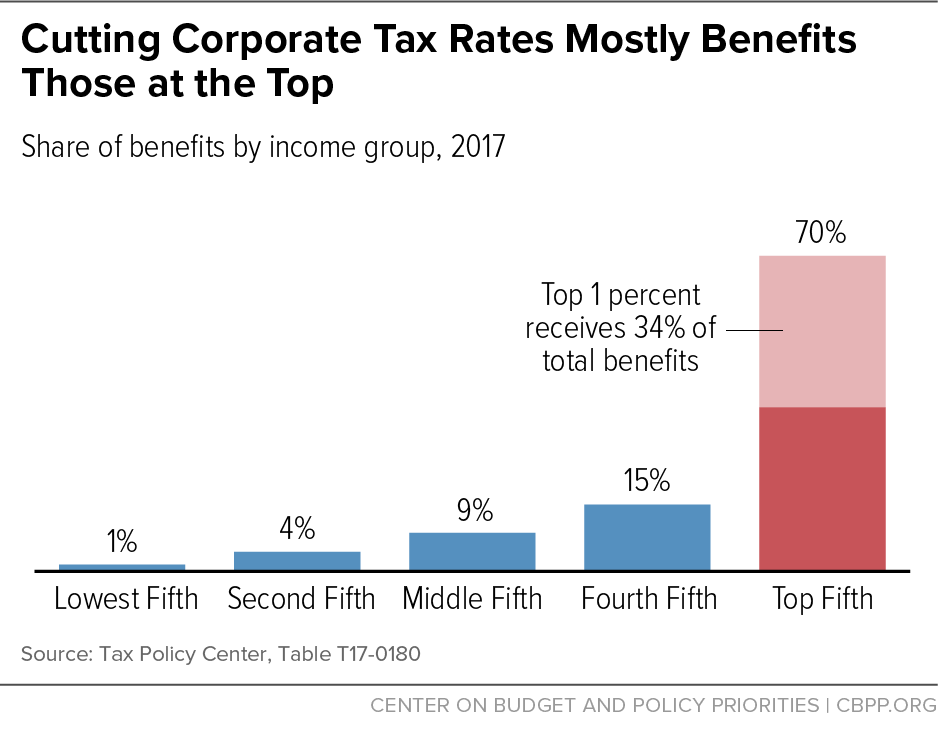

Corporate Tax Cuts Mainly Benefit Shareholders And Ceos Not Workers Center On Budget And Policy Priorities

The Benefits Of Cutting The Corporate Income Tax Rate Tax Foundation

Does Lowering The Corporate Tax Rate Spur Economic Growth

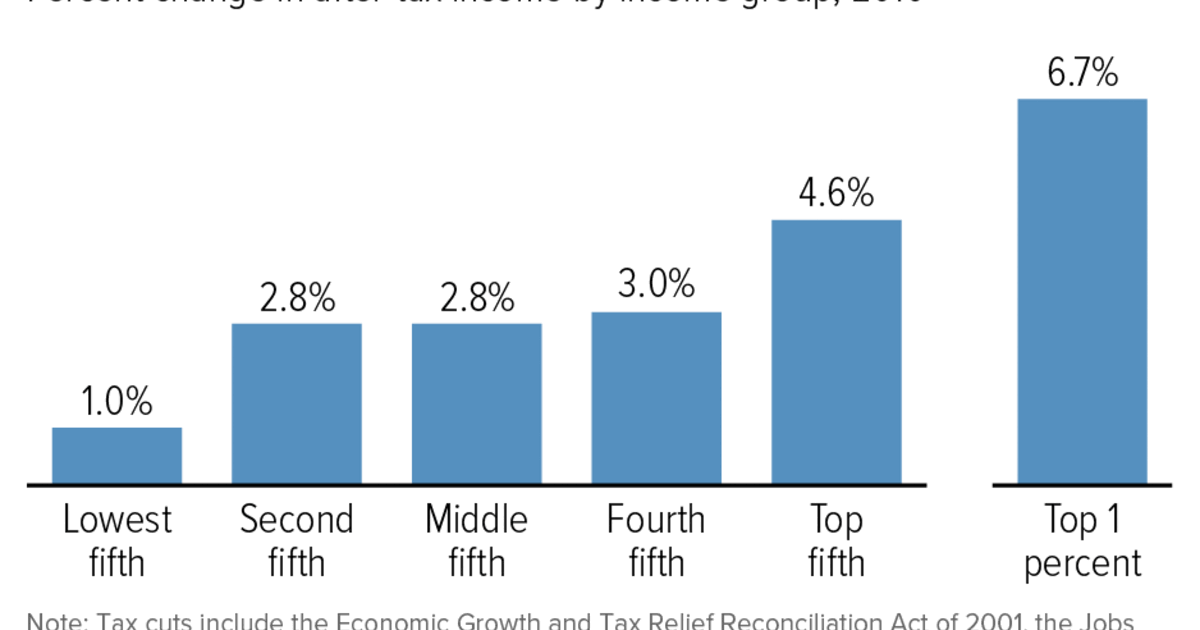

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

The Effect Of Tax Cuts On Economic Growth And Revenue Economics Help

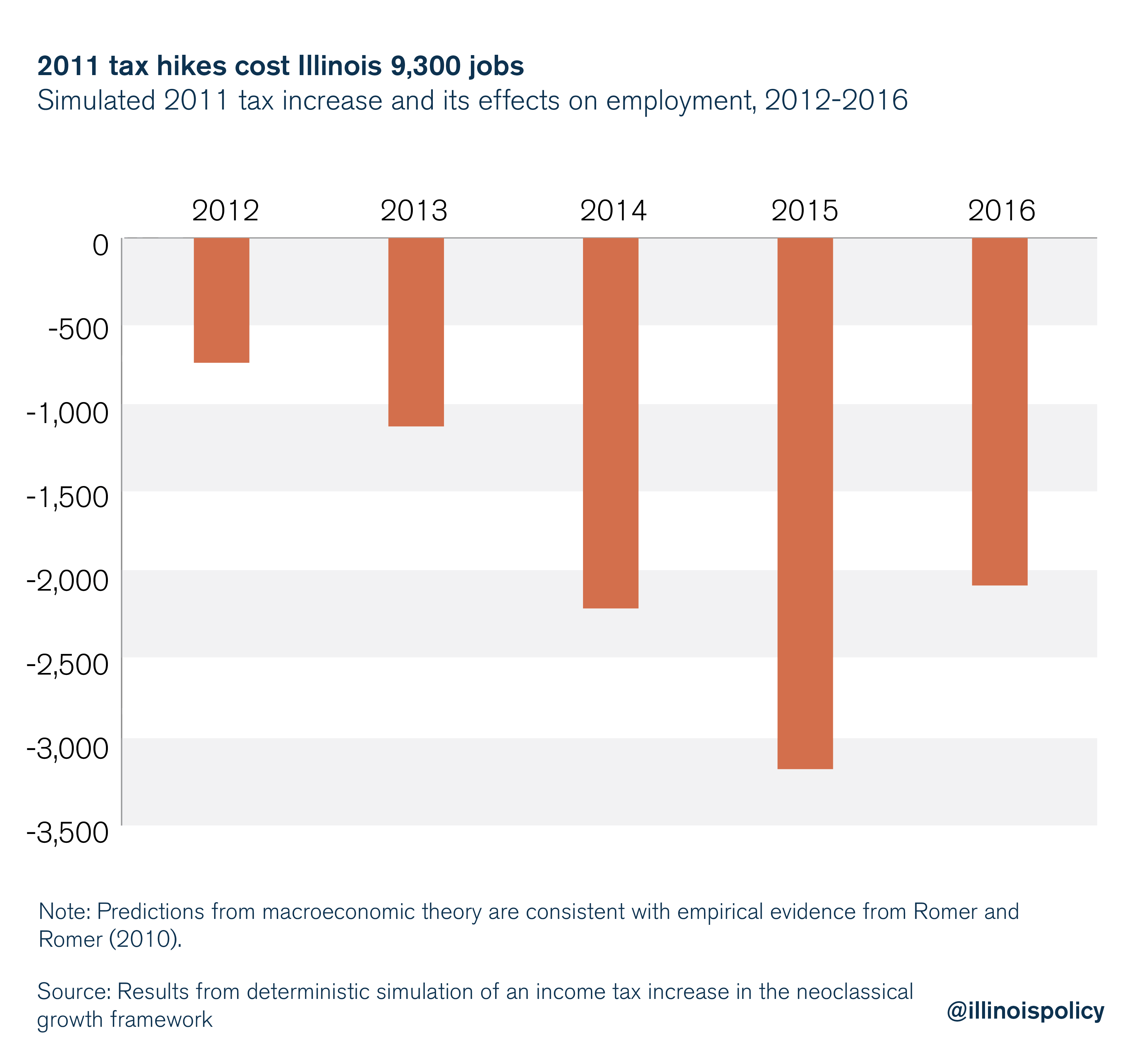

Why The 2017 Tax Hikes Will Harm Illinois Economy Illinois Policy

Corporation Tax In The Republic Of Ireland Wikipedia

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Pdf The U S Corporate Tax Reform And Its Macroeconomic Outcomes

How Higher Corporate Taxes Would Affect You Forbes Advisor

Growth Dividend From A Lower Corporate Tax Rate Tax Foundation

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Is Corporation Tax Good Or Bad For Growth World Economic Forum

The Progressive Case For Abolishing The Corporate Income Tax Milken Institute Review

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Biden S Proposed Tax Hikes Would Do Little To Slow The Economy Tax Policy Center

Biden Corporate Tax Increase Details Analysis Tax Foundation